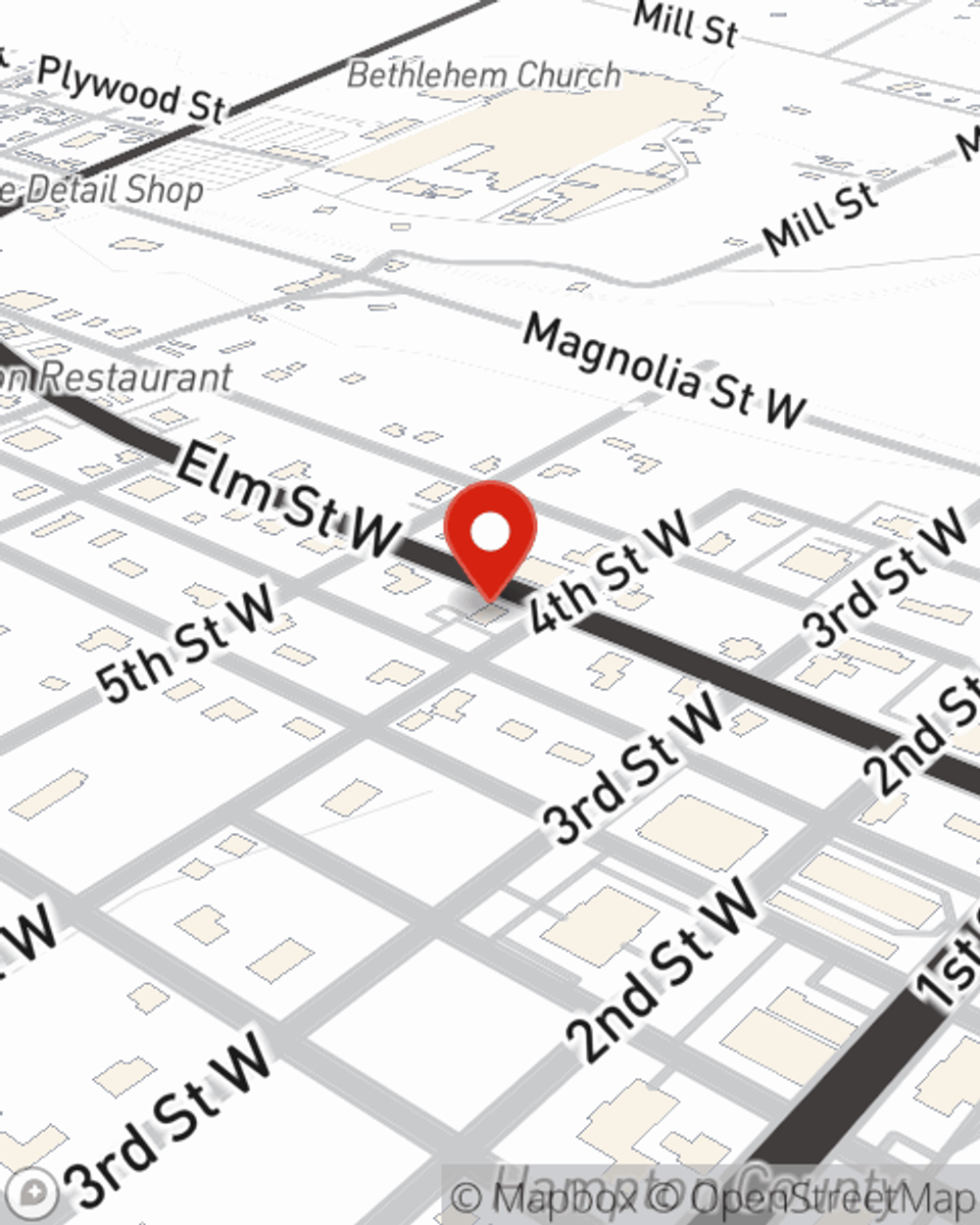

Business Insurance in and around Hampton

One of Hampton’s top choices for small business insurance.

Insure your business, intentionally

Insure The Business You've Built.

You may be feeling overwhelmed with running your small business and that you have to handle it all alone. State Farm agent Debbie Elrod, a fellow business owner, can relate to the responsibility on your shoulders and is here to help you build a policy that's right for your needs.

One of Hampton’s top choices for small business insurance.

Insure your business, intentionally

Insurance Designed For Small Business

For your small business, whether it's a window treatment store, a tailoring service, a deli, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like accounts receivable, equipment breakdown, and extra expense.

When you get a policy through the reliable name for small business insurance, your small business will thank you. Call or email State Farm agent Debbie Elrod's team today with any questions you may have.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Debbie Elrod

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.