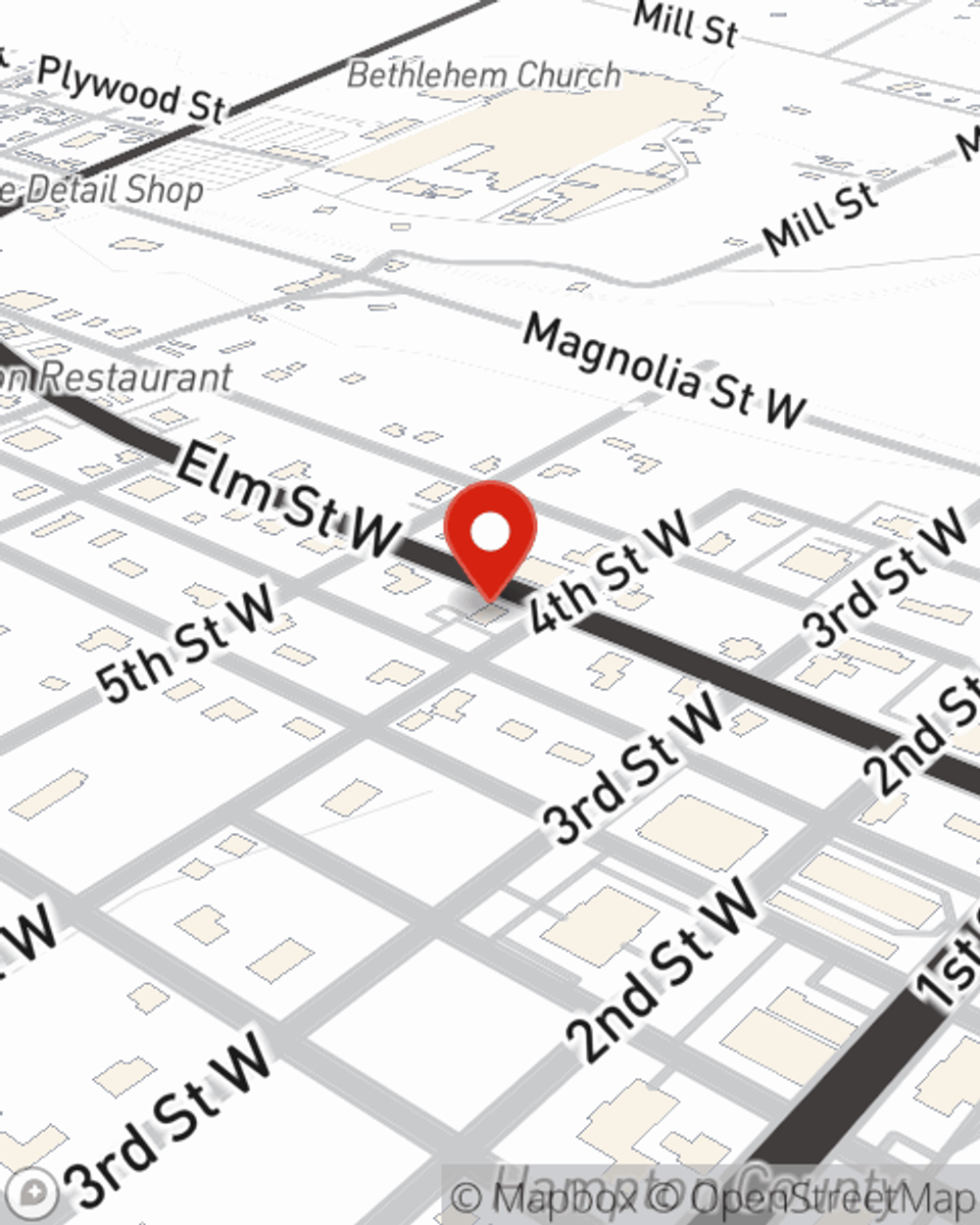

Homeowners Insurance in and around Hampton

Looking for homeowners insurance in Hampton?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

You want your home to be a place to take it easy after a long day. That doesn't happen when you're worrying about laundry, and especially if your home isn't insured. That's why you need us at State Farm, so all you have to worry about is the first part.

Looking for homeowners insurance in Hampton?

Apply for homeowners insurance with State Farm

Don't Sweat The Small Stuff, We've Got You Covered.

Debbie Elrod will help you feel right at home by getting you set up with reliable insurance that fits your needs. Home insurance from State Farm not only covers the structure of your home, but can also protect precious items like your favorite chair.

It's always the right move to get coverage with State Farm's homeowners insurance. Then, you won't have to worry about the unanticipated ice storm damage to your property. Contact Debbie Elrod today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Debbie at (803) 943-3816 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

What to do after a hurricane

What to do after a hurricane

Helpful tips to prevent further water damage, safely begin cleaning up and finding a contractor to help repair damage to your property.

Debbie Elrod

State Farm® Insurance AgentSimple Insights®

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

What to do after a hurricane

What to do after a hurricane

Helpful tips to prevent further water damage, safely begin cleaning up and finding a contractor to help repair damage to your property.